Never Sell a Stock? Here’s What Really Happens (Good and Bad)

What if you bought a stock, and then never sold it? No fancy exit strategy. No obsessing over price charts. Just a quiet, patient hold… forever.

Table Of Content

- 1. You Accumulate Long-Term Capital Gains (But Only on Paper)

- 2. You May Receive Dividends

- 3. The Power of Compounding Works in Your Favour

- 4. You Avoid Emotional Trading Mistakes

- 5. But You Face Opportunity Cost

- 6. You Still Face Business Risks

- 7. Estate Benefits: Stepped-Up Cost Basis (U.S. Specific)

- 8. You Create a Legacy Investment

- Final Thoughts: Sometimes, the Best Move Is No Move

- FAQs: What Happens If You Never Sell a Stock?

- Is it bad to never sell a stock?

- Will I still earn money if I never sell?

- Can I lose money if I never sell a stock?

- If a company goes bankrupt, what happens to its stock?

- Do I pay taxes if I don’t sell my stock?

- What if the stock keeps growing forever?

- Will I miss better investment opportunities by never selling?

- Can I gift stocks without selling them?

- Do I still get dividends if I never sell?

- Is holding stocks forever a good strategy in India?

- What if I die without selling my stock?

Sounds wild? Maybe. But some of the world’s wealthiest investors swear by this approach. In fact, Warren Buffett—arguably the GOAT of investing—once said his favourite holding period is “forever.”

This idea of eternal holding sparks curiosity for beginners and seasoned investors alike. Is it wise? Risky? Boring? Brilliant?

In this article, we’ll break down exactly what happens when you never sell a stock. From growing your wealth slowly (but surely), to understanding dividends, taxes, emotional discipline, and generational planning—this deep dive might just change the way you think about investing.

1. You Accumulate Long-Term Capital Gains (But Only on Paper)

If you never sell your stock, your capital gains remain unrealised. This means you don’t owe any capital gains tax unless you sell.

Think of it like buying a plot of land that increases in value over time. As long as you don’t sell it, you don’t have to pay property transfer taxes and the value keeps on increasing behind the scenes.

Pro Tip: In India, long-term capital gains (LTCG) on investments are taxed at 12.5% after the first ₹1 lakh of annual gains. By holding your investments instead of selling, you can defer paying this tax indefinitely, allowing your capital to compound more efficiently over time.

2. You May Receive Dividends

Many companies pay dividends—cash rewards to shareholders. If you never sell, you continue to receive these payouts.

Over time, especially if you reinvest these dividends, your wealth can grow exponentially.

It’s like owning a mango tree. You don’t cut it down (sell it), and it keeps giving you fruit (dividends) every season.

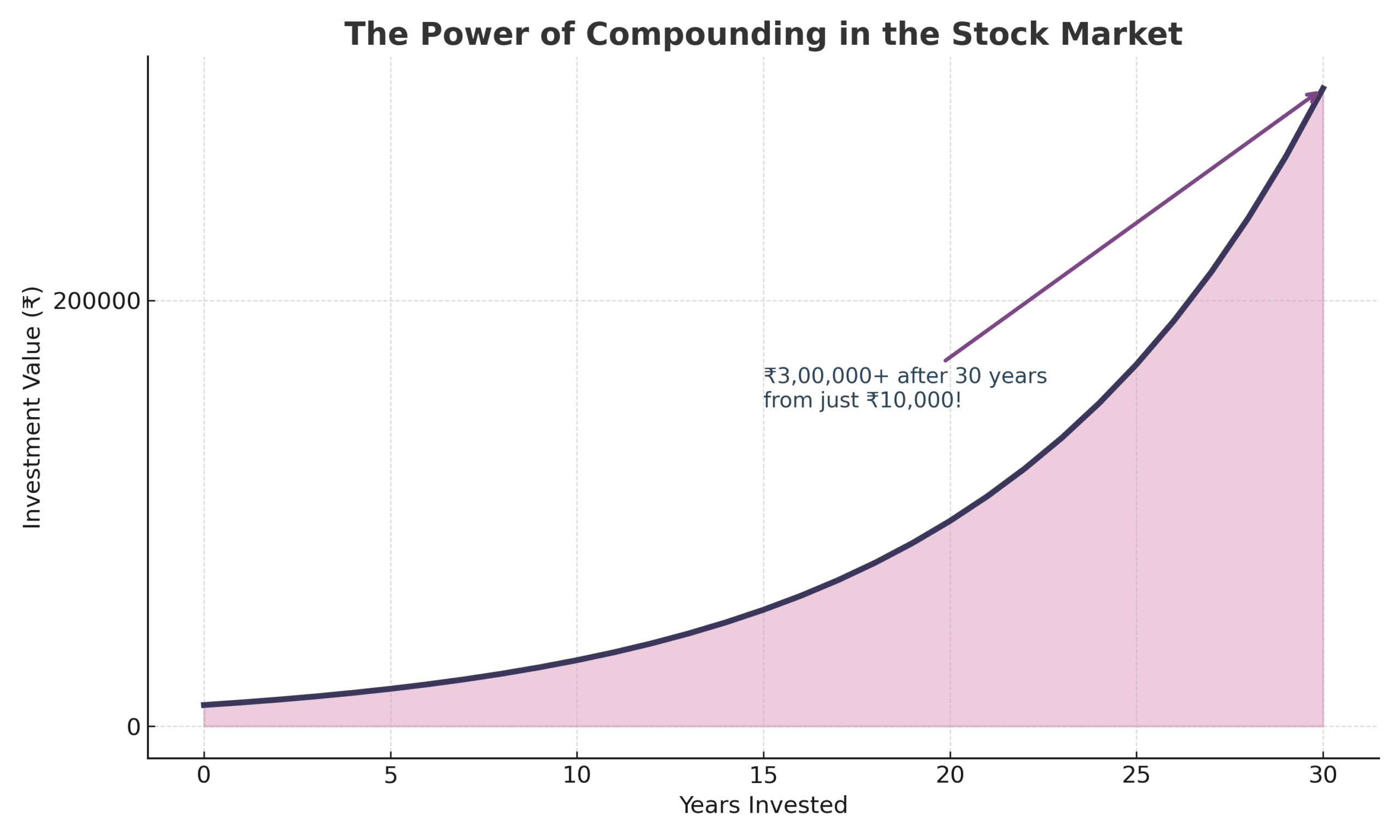

3. The Power of Compounding Works in Your Favour

Holding a stock for decades allows compounding to play its magic. Your capital appreciates, and any reinvested dividends further accelerate growth.

Example: A ₹1 lakh investment that grows at 12% annually becomes ₹32 lakh in 25 years. No selling required. (Let’s ignore the inflation adjustments for a minute!)

4. You Avoid Emotional Trading Mistakes

You eliminate the temptation to panic during market downturns or greed during bull runs by deciding not to sell ever.

This discipline helps avoid common psychological traps like:

- Selling too early due to fear

- Buying high and selling low

- Chasing market trends

It’s like planting a tree and not digging it up every few months to check the roots. You let it grow.

5. But You Face Opportunity Cost

Holding a single stock indefinitely can mean missing out on better opportunities. What if another stock offers superior returns? Or what if the company you’re holding begins to underperform? Staying invested shouldn’t mean staying stagnant.

Mitigation Tip: Diversify your portfolio so you’re not tied to one company’s fate.

6. You Still Face Business Risks

Companies can fail. Even blue-chip stocks may lose relevance.

- Nokia, Kodak, and Lehman Brothers were once investor darlings.

- Long-term holders who never sold suffered heavily.

Takeaway: Buy-and-hold is not a license to ignore fundamentals. Keep monitoring the company’s health.

7. Estate Benefits: Stepped-Up Cost Basis (U.S. Specific)

In countries like the U.S., stocks passed on to heirs receive a “stepped-up basis,” meaning the gains during your lifetime are effectively tax-free for them.

While India doesn’t have this provision, gifting or bequeathing long-held shares still transfers value efficiently.

8. You Create a Legacy Investment

Holding a stock forever allows you to build generational wealth.

You could:

- Leave shares for your children

- Donate stocks to charity

- Use them as collateral for a loan

Your wealth grows silently, without ever needing to click the “Sell” button.

Final Thoughts: Sometimes, the Best Move Is No Move

When everyone is obsessed with quick gains, hot tips, and constant action, doing nothing can feel radical. But holding onto a good stock forever isn’t about being lazy—it’s about trusting time, compounding, and the power of patience.

Sure, not every company is built to last. And yes, life throws curveballs. But for the right businesses, with solid fundamentals and long-term potential, holding on could mean riding the wave of growth through decades of innovation, expansion, and wealth creation.

Never selling a stock isn’t a strategy for everyone. It requires calm nerves, deep conviction, and a zoomed-out perspective. But if done right, it can turn a ₹10,000 investment into a legacy—not just for your portfolio, but for generations to come.

So the next time you’re tempted to hit that “sell” button, pause. Zoom out. And ask yourself: What would forever feel like?

Remember:

Time in the market beats timing the market.

FAQs: What Happens If You Never Sell a Stock?

Is it bad to never sell a stock?

Not always. It depends on the company’s performance, its future outlook, and whether the investment continues to support your personal financial goals.

Will I still earn money if I never sell?

Yes, through dividends and capital appreciation.

Can I lose money if I never sell a stock?

Yes, especially if the stock price drops sharply or the company’s fundamentals deteriorate or it fails altogether.

If a company goes bankrupt, what happens to its stock?

You may lose your investment entirely if the company is liquidated.

Do I pay taxes if I don’t sell my stock?

No capital gains tax is owed until you sell. But dividends are taxable.

What if the stock keeps growing forever?

Great! Your wealth keeps growing too. But always monitor fundamentals.

Will I miss better investment opportunities by never selling?

Possibly. Opportunity cost is real. Diversify to manage this.

Can I gift stocks without selling them?

Yes, you can transfer them to family or friends.

Do I still get dividends if I never sell?

Yes, you continue to receive dividends if the company pays them.

Is holding stocks forever a good strategy in India?

Yes, if you choose fundamentally strong companies with growth potential.

What if I die without selling my stock?

Your shares go to your legal heirs or nominees, as per your will or succession law.

Found this guide helpful? Feel free to bookmark it, share it with fellow traders, and follow along for more straightforward, experience-based insights. I’m here to share what I’ve learned along the way — no hype, just honest trading lessons.