Jyoti Limited Discloses GST Litigation and Its Impact: What Investors Should Know

On 20th May 2025, Jyoti Limited made a formal disclosure to BSE Limited (Bombay Stock Exchange) regarding a Goods and Services Tax (GST) matter. This disclosure was made under Regulation 30 of the Securities and Exchange Board of India (SEBI), which mandates listed companies to inform stock exchanges about material events that may impact the company or its stakeholders.

Table Of Content

- Details of the GST Order

- Financial Impact: Tax Demand Breakdown

- Company’s Response: Appeal and Confidence

- Implications for Stakeholders

- Conclusion: A Measured and Transparent Approach

- FAQs: Jyoti Limited GST Litigation

- What is the recent GST issue disclosed by Jyoti Limited?

- What is the total tax demand mentioned in the order?

- Why was the GST order issued to Jyoti Limited?

- When did Jyoti Limited receive the order?

- How is Jyoti Limited responding to the order?

- Will this GST order impact Jyoti Limited’s business?

- What does this disclosure mean for investors?

- Is this a common issue for companies under the GST regime?

- Where can I find the official disclosure?

- ⚠️ Disclaimer – Jyoti Limited GST Litigation

The case centres around a tax order issued to Jyoti Limited for the financial year 2018–19, relating to the wrongful availment of Input Tax Credit (ITC). While legal and tax-related disclosures are not uncommon for businesses, this communication demonstrates Jyoti Limited’s commitment to transparency and corporate governance.

Details of the GST Order

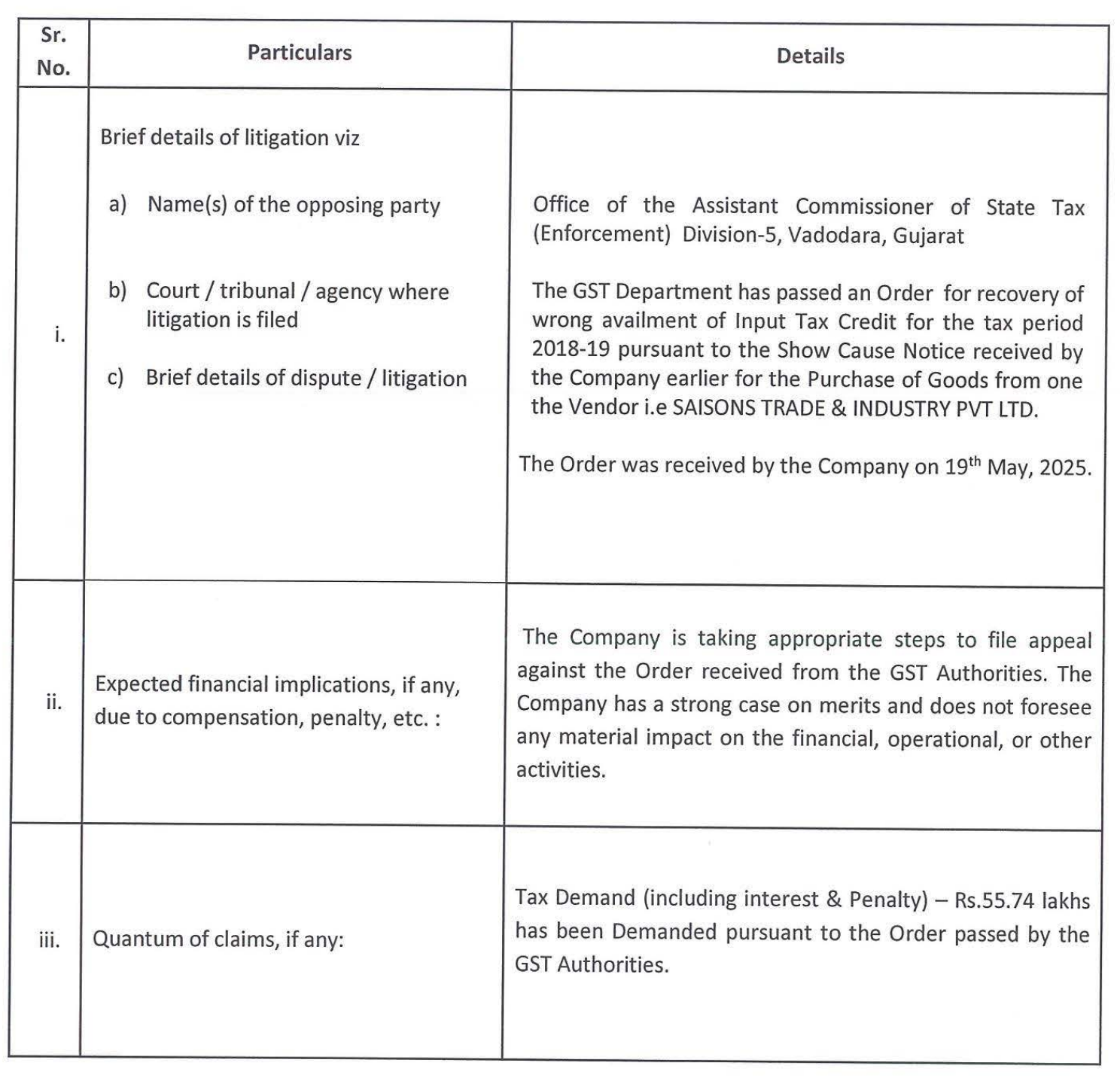

The order was issued by the Office of the Assistant Commissioner of State Tax (Enforcement), Division-5, Vadodara, Gujarat. Jyoti Limited received the order on 19th May 2025, following a Show Cause Notice.

The dispute arises from purchases made from a vendor named Saisons Trade & Industry Pvt Ltd. According to the authorities, the ITC claimed on purchases from this vendor was not in accordance with GST provisions, thereby leading to a demand for tax recovery.

Financial Impact: Tax Demand Breakdown

The total demand raised by the GST department amounts to ₹55.74 lakhs, which includes:

- The core tax amount,

- Interest on the tax amount,

- And penalties under applicable provisions of the GST Act.

While this amount is notable, especially for compliance and financial reporting, Jyoti Limited has clarified that it does not expect any significant impact on its operations or financial performance.

Company’s Response: Appeal and Confidence

Jyoti Limited has stated that it plans to appeal against the order. The company believes it has a strong legal case and is confident that it will be able to defend its position successfully.

The company also reassured its stakeholders that:

- There will be no material impact on its business operations.

- The financial exposure is manageable and has been duly disclosed in accordance with SEBI regulations.

- They are actively engaging with their legal advisors to proceed with the appeal.

This approach reflects a well-structured risk management framework, where legal challenges are dealt with promptly while keeping regulatory bodies and investors informed.

Implications for Stakeholders

For investors, shareholders, and market analysts, this disclosure is significant for several reasons:

- It shows that Jyoti Limited is committed to regulatory compliance and transparency.

- It demonstrates the company’s preparedness in handling legal and tax-related risks.

- It reassures stakeholders that even in the face of litigation, business continuity and performance remain unaffected.

Conclusion: A Measured and Transparent Approach

Jyoti Limited’s disclosure of its GST litigation offers insight into how the company is addressing ongoing regulatory matters. While tax disputes can raise concerns, the company has communicated the issue, outlined its legal response, and assessed the potential impact as minimal, reflecting its current governance approach.

As the appeal moves forward, stakeholders can expect continued updates in line with the company’s stated commitment to transparency and regulatory compliance.

FAQs: Jyoti Limited GST Litigation

What is the recent GST issue disclosed by Jyoti Limited?

Jyoti Limited has disclosed a tax order related to the wrongful availment of Input Tax Credit (ITC) for the financial year 2018–19. The order was issued by the Assistant Commissioner of State Tax (Enforcement), Division-5, Vadodara, Gujarat.

What is the total tax demand mentioned in the order?

The order demands a total of ₹55.74 lakhs, which includes:

The disputed tax amount, Interest, and Penalties under the GST Act.

Why was the GST order issued to Jyoti Limited?

The order was based on a Show Cause Notice related to purchases made from a vendor named Saisons Trade & Industry Pvt Ltd. Authorities believe Jyoti Limited claimed ITC on transactions that were not eligible under GST law.

When did Jyoti Limited receive the order?

The company received the order on 19th May 2025, and disclosed it formally to BSE Limited on 20th May 2025 under Regulation 30 of SEBI.

How is Jyoti Limited responding to the order?

Jyoti Limited plans to appeal against the order. The company believes it has a strong case and has expressed confidence that the matter will not materially affect its financial or operational stability.

Will this GST order impact Jyoti Limited’s business?

According to the company, no significant financial or operational impact is expected. The amount involved is manageable, and appropriate legal steps are being taken.

What does this disclosure mean for investors?

The disclosure shows Jyoti Limited’s transparency, commitment to compliance, and corporate governance standards. Investors can take this as a positive sign that the company addresses regulatory matters responsibly.

Is this a common issue for companies under the GST regime?

Yes, ITC-related disputes are relatively common under India’s evolving GST framework. Many businesses face similar audits and notices, especially involving third-party vendors.

Where can I find the official disclosure?

The official disclosure was submitted to BSE Limited and can typically be found in the corporate announcements section of Jyoti Limited’s page on the BSE website.

⚠️ Disclaimer – Jyoti Limited GST Litigation

This post is meant for educational and entertainment purposes only. I am NOT a SEBI-registered advisor, and nothing written here should be interpreted as investment advice. Always consult a qualified financial professional before making investment or trading decisions. Or at the very least, consult your cat. 🐱