Gold Price Analysis – 15 May 2025 – Free Insights!

Hi everyone,

Table Of Content

Gold bugs, gather around. Today, we’re digging into XAUUSD — and let’s just say, the market has been behaving like that overly enthusiastic guest at a party… who suddenly remembered they left the stove on. 🫠

What Just Happened?

Gold (XAUUSD) had been on a spectacular run since last year, delivering strong bullish momentum and printing candles that probably gave FOMO to even the most disciplined of traders. From late 2023 into mid-2024, it seemed like nothing could stop the yellow metal.

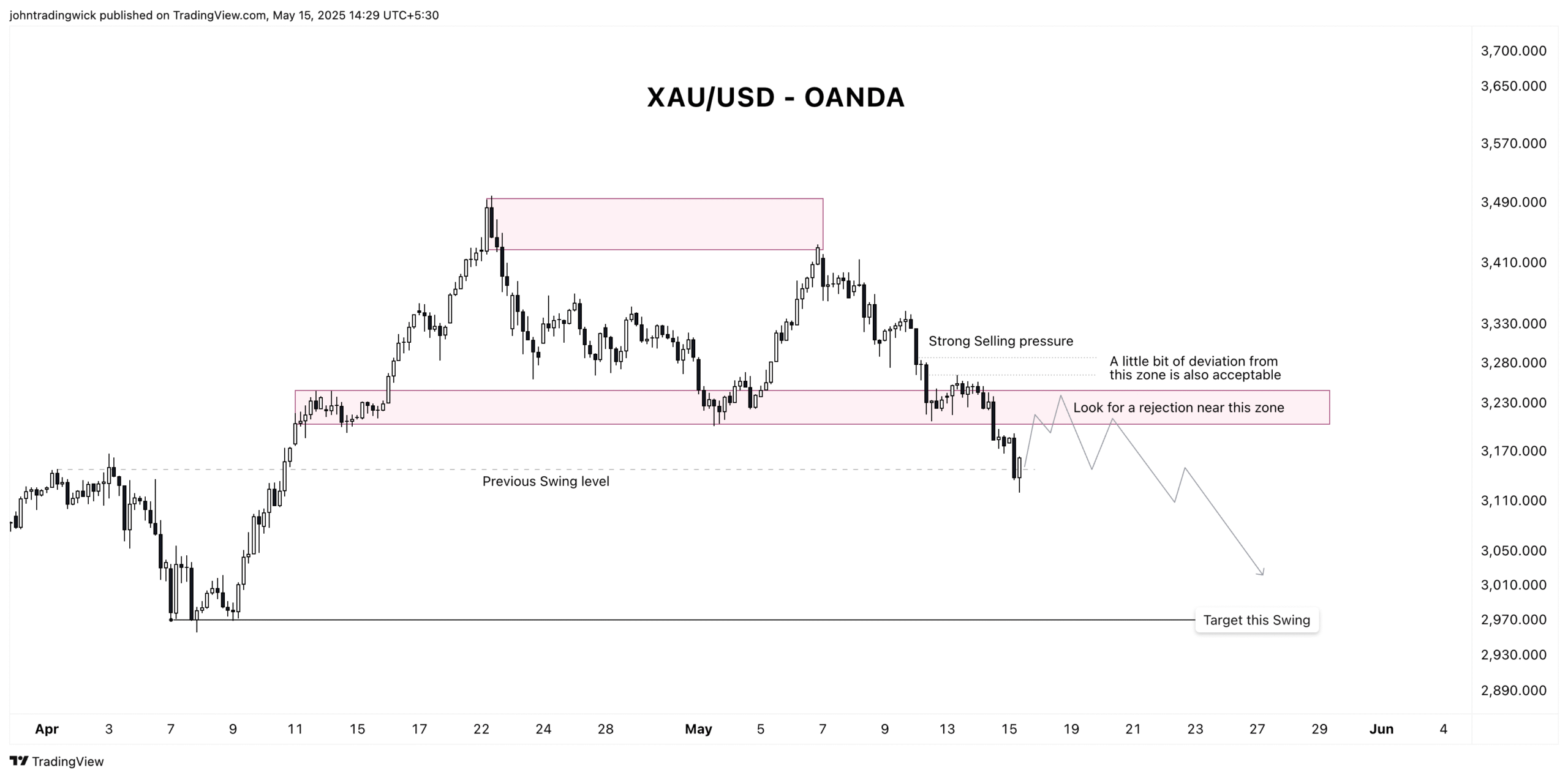

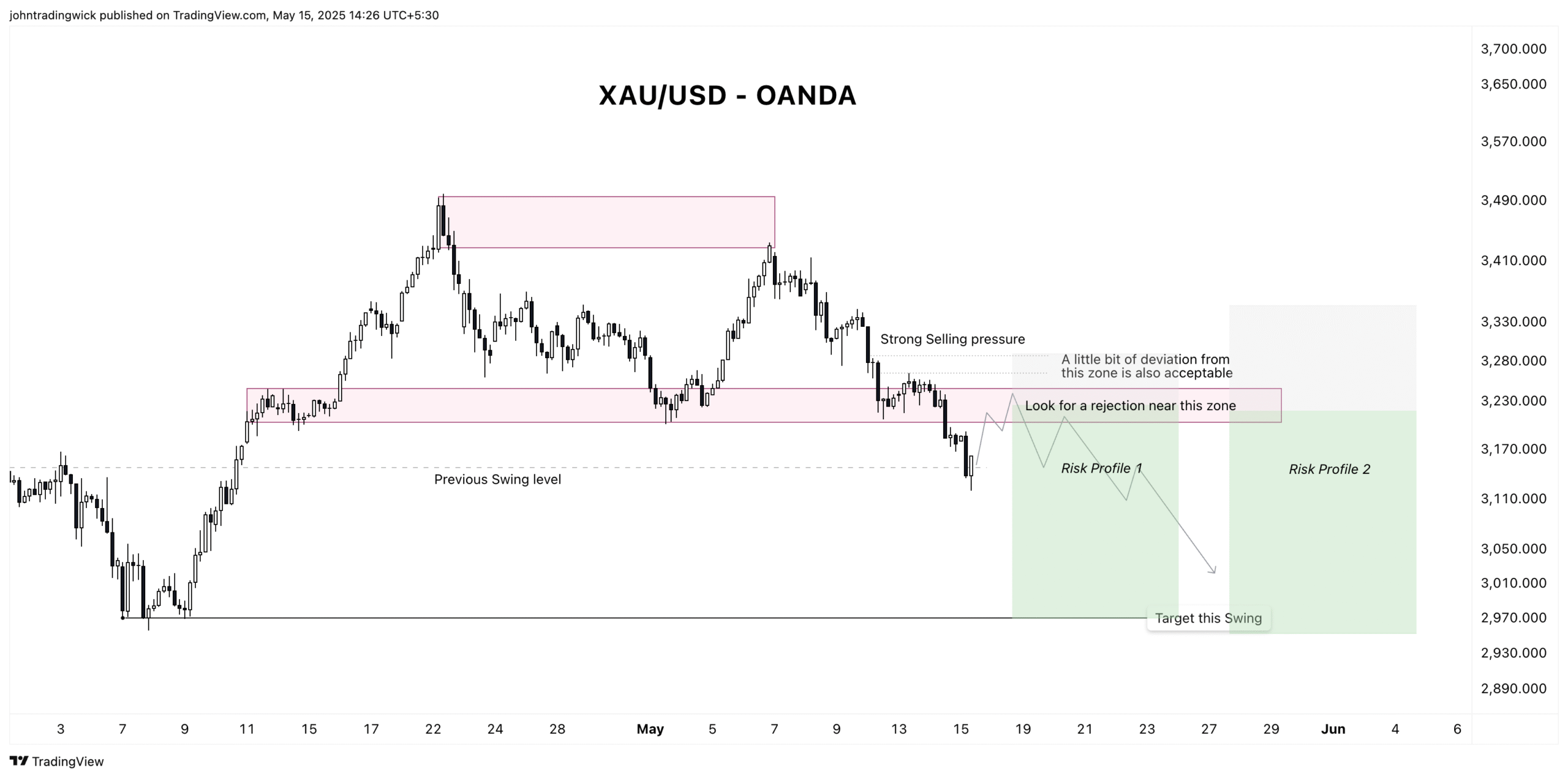

But then came mid-April — and the party started to lose steam. After a month-long vertical sprint, gold hit a wall in the $3400–$3500 region. That level turned out to be a rejection zone.

Since last week, we’ve seen swift selling — a classic “gravity still works” situation — dragging the price down to a new monthly low near $3120. That’s a $300+ correction, which is significant, even by gold’s dramatic standards.

Structure Check: Is the Bull Tired?

The 4-hour (4H) chart tells an interesting story: the structure has flipped. We’re now seeing lower highs and lower lows — the textbook signs of bearish pressure taking over. This short-term trend change might just be the first crack in a much larger, daily-timeframe reversal.

It’s like the market was flying a private jet and now it’s looking for a parachute. 🎈

But let’s not get ahead of ourselves — just because we see a breakdown doesn’t mean the whole trend collapses immediately. Reversals, especially in gold, tend to be messy and filled with head-fakes.

Key Levels & What I’m Watching

Let’s talk zones and possibilities.

- Support turned resistance zone: $3200–$3300 This is the region I’m laser-focused on. It was a key zone on the way up — and now, it could act as a trap for buyers and a gift for sellers. If we see a retest with weak bullish momentum, it could be a solid short entry.

- Current support: ~$3120 That’s the recent low and a potential bounce zone. If the market wants to shake out weak shorts, it could bounce from here — but in my view, any bounce here might be temporary unless bulls regain real control.

- Psychological level: $3000 We’re not there yet — but if this bearish structure continues, $3000 could be on the table. And you know how markets love round numbers. If price approaches this level, expect drama, noise, and lots of tweets.

Momentum Says… Chill

While gold still has that long-term bullish sparkle, momentum is waning on multiple timeframes:

- The RSI on 4H has been making lower highs even as price previously made higher highs — a classic bearish divergence.

- On the daily, we’re seeing early signs of trend exhaustion: long wicks, bearish engulfing candles, and reduced follow-through after bullish pushes.

This makes the current bounce attempt look more like a sigh of relief than a second wind.

Trade Setups: One Size Doesn’t Fit All

Here’s how I’m looking at potential trades, based on different risk appetites:

🟢 Conservative Setup:

- Wait for a retest of $3200–$3300, paired with a clear rejection candle or a bearish pattern (e.g., double top, shooting star).

- Ideal for traders who prefer confirmation before diving in.

- Wider stop loss, aiming for a potential move toward $3050–$3000.

🔴 Aggressive Setup:

- Look to short near the first signs of stalling in the $3200 zone, especially if the market spikes up impulsively and immediately loses steam.

- Tighter stop loss, quicker execution.

- Higher risk, but better R:R if timed well.

Both setups can be taken independently or blended for a layered approach — depending on your risk management and caffeine intake. ☕😉

Closing Thoughts

We’ve seen gold fly high and now it’s wobbling. Whether this is a small correction or the beginning of a larger shift, the key is to stay flexible. This market is known for fake-outs, sentiment swings, and being aggressively emotional — kind of like a crypto trader during FOMC week.

That said, don’t marry your bias. Gold can still surprise both bulls and bears — so plan the trade, manage the risk, and don’t chase candles like they owe you money.

⚠️ Disclaimer – Gold Price Analysis – 15 May 2025

This post is meant for educational and entertainment purposes only. I am not a financial advisor, and nothing written here should be interpreted as investment advice. Always consult a qualified financial professional before making investment or trading decisions. Or at the very least, consult your cat. 🐱

If you found this guide helpful, consider sharing it with fellow traders. Bookmark, share, and follow for clear, jargon-free investing wisdom — straight from someone who’s been there.