How to Start Trading with 10,000 Rupees in India

Starting your trading journey with ₹10,000 might seem modest, but it’s a practical and strategic way to enter the stock market. Just as you wouldn’t learn to drive by immediately hitting the highway, beginning with a smaller capital allows you to understand the market dynamics, develop discipline, and build confidence without significant financial risk.

Table Of Content

- Why ₹10,000 is a Smart Starting Point

- A Step-By-Step Guide to Start Trading with 10000 Rupees

- Step 1: Choose the Right Trading Platform (Broker)

- Step 2: Decide Your Trading Style

- Swing Trading

- Intraday Trading

- Long-Term Investing

- Step 3: Stick to Low-Capital Strategies

- Step 4: Use Basic Technical Tools

- Step 5: Journal Everything

- Step 6: Avoid Common Pitfalls

- Final Thoughts

- 📌 Summary Checklist

- Frequently Asked Questions (FAQs)

- Is ₹10,000 enough to start trading in India?

- Which type of trading is best suited for small capital like ₹10,000?

- Can I buy stocks worth more than ₹10,000 using leverage or margin?

- What kind of returns can I expect with ₹10,000?

- Which stocks should I buy with ₹10,000?

- What if I lose my ₹10,000 investment?

- How many stocks should I buy with ₹10,000?

- Do I need to learn technical analysis to trade with ₹10,000?

- Is intraday trading advisable for beginners with small capital?

- Are there any mobile apps or tools I should use to start trading?

- How much brokerage or fees will I pay on trades?

- What if I don’t see profits in the first few months?

Why ₹10,000 is a Smart Starting Point

Think of trading as learning a new instrument. You wouldn’t buy the most expensive guitar on day one; instead, you’d start with a basic model to practice and understand the nuances. Similarly, starting with ₹10,000:

- Minimises Risk: Reduces the potential for significant losses while you’re still learning.

- Encourages Discipline: Forces you to make calculated decisions and manage your resources wisely.

- Facilitates Learning: Provides a hands-on experience without overwhelming financial pressure.

A Step-By-Step Guide to Start Trading with 10000 Rupees

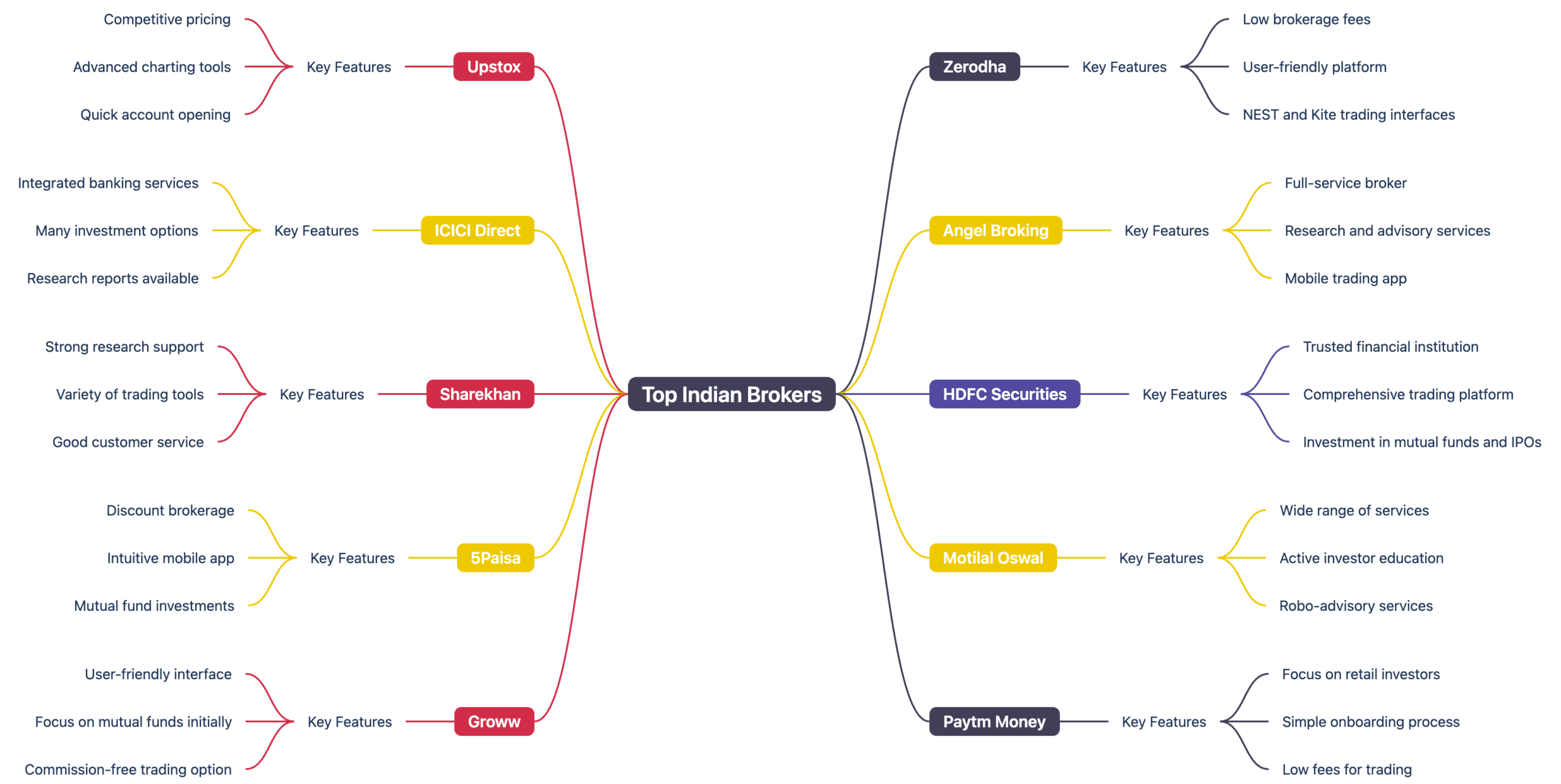

Step 1: Choose the Right Trading Platform (Broker)

Selecting a broker is akin to choosing a reliable vehicle for your journey. You need something dependable, efficient, and suited to your needs. Here’s a comparison of some beginner-friendly brokers in India:

| Broker | Account Opening Fee | Annual Maintenance Charge (AMC) | Brokerage Charges | Notable Features |

|---|---|---|---|---|

| Zerodha | ₹0 | ₹300 | ₹0 for delivery; ₹20 per intraday | Advanced charting tools, educational resources |

| Upstox | ₹249 | ₹300 | ₹20 per order | User-friendly interface, fast execution |

| Groww | ₹0 | ₹0 | ₹0 for delivery; ₹20 per intraday | Clean & simple platform, ideal for beginners |

| Angel One | ₹0 | ₹450 | ₹20 per order | AI-powered recommendations, extensive research support |

Note: Charges are indicative and may vary. Always check the latest fee structure on the broker’s official website.

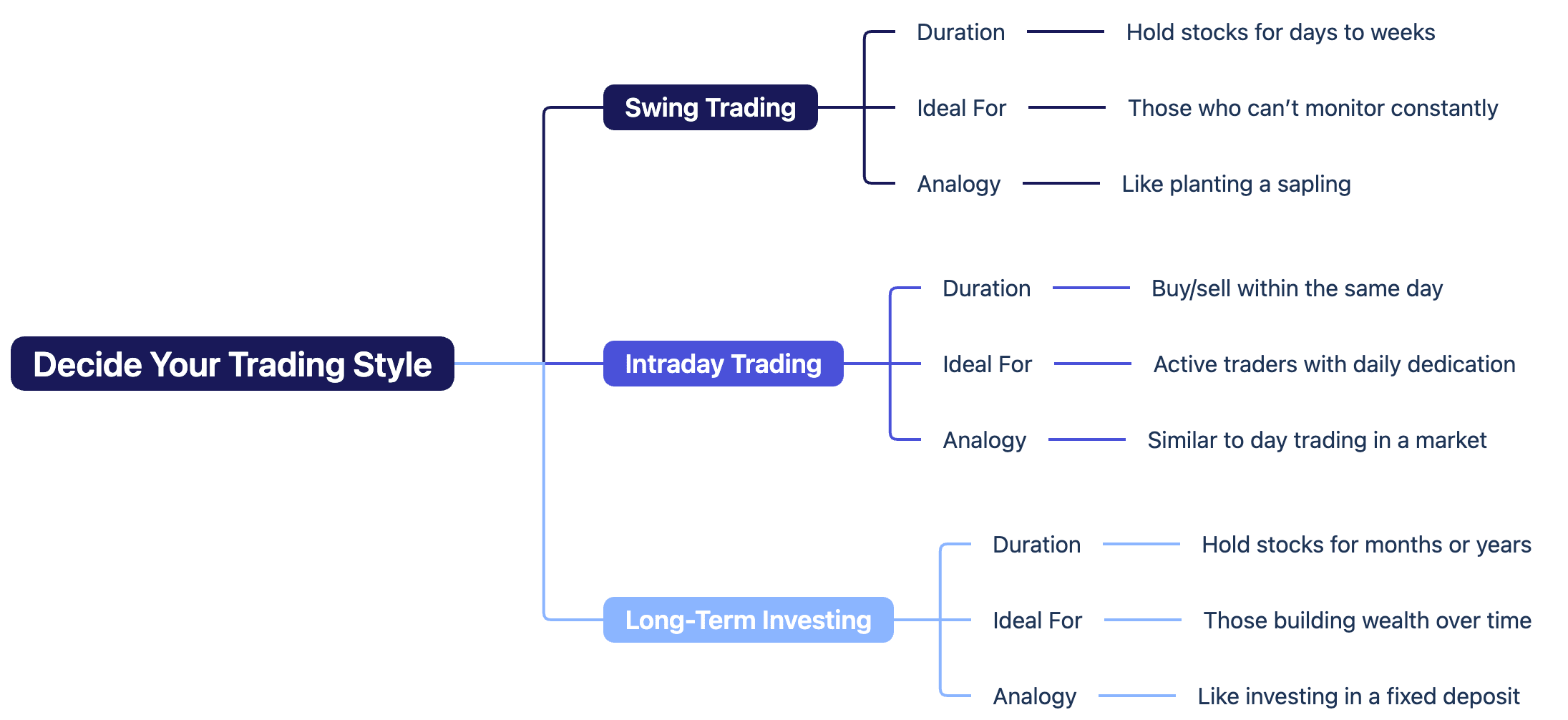

Step 2: Decide Your Trading Style

Just as travellers choose different modes of transport—some prefer the speed of a bike, others the comfort of a car—traders have various styles:

Swing Trading:

- Duration: Hold stocks for several days to weeks.

- Ideal For: Those who can’t monitor the market constantly.

- Analogy: Like planting a sapling and waiting for it to grow over time.

Intraday Trading:

- Duration: Buy and sell stocks within the same day.

- Ideal For: Active traders who can dedicate time daily.

- Analogy: Similar to day trading goods in a market—buying in the morning, selling by evening.

Long-Term Investing:

- Duration: Hold stocks for months or years.

- Ideal For: Those looking to build wealth over time.

- Analogy: Like investing in a fixed deposit—steady and long-term.

Step 3: Stick to Low-Capital Strategies

With ₹10,000, it’s crucial to employ strategies that protect your capital:

- Diversify: Don’t invest the entire amount in one stock. Spread it across 2-3 stocks to mitigate risk.

- Set Stop-Loss Orders: Determine a price point to sell a stock to prevent losses when a trade goes awry.

- Avoid Leverage: Refrain from borrowing funds to trade, as it can amplify losses.

Think of your capital as a small boat. To prevent it from capsizing, distribute weight evenly and avoid overloading.

Step 4: Use Basic Technical Tools

Technical analysis helps in making informed decisions. Start with these basic yet powerful tools:

- Moving Averages: Smooth out price fluctuations to reveal the underlying trend direction.

- Relative Strength Index (RSI): Highlights whether an asset is potentially overbought or oversold based on recent price movements.

- Support and Resistance Levels: Identify price points where stocks tend to reverse direction.

These tools are like a compass and map for a traveller, guiding direction and highlighting potential obstacles.

Step 5: Journal Everything

Maintaining a trading journal is essential, and it helps in analysing your performance.

- Record Trades: Note down entry and exit points, reasons for the trade, and outcomes.

- Analyse Performance: Review past trades to identify patterns and areas of improvement.

- Refine Strategies: Use insights to adjust and enhance your trading approach.

A trading journal is like a travel diary, helping you remember routes taken, experiences encountered, and lessons learned.

Step 6: Avoid Common Pitfalls

Steer clear of these common mistakes:

- Following Unverified Tips: Relying on hearsay can lead to losses.

- Overtrading: Excessive trading can erode profits due to fees and potential mistakes.

- Ignoring Research: Always base decisions on thorough analysis.

Final Thoughts

Kickstarting your trading journey with just ₹10,000 isn’t just possible—it’s a smart way to learn the ropes. With disciplined strategies, the right beginner tools, and a mindset focused on growth, you can lay a solid foundation for long-term success in the markets.

📌 Summary Checklist

| Task | Status |

|---|---|

| Open a trading account with a suitable broker | ⃝ |

| Choose a trading style that fits your schedule | ⃝ |

| Learn and apply basic technical analysis tools | ⃝ |

| Start a trading journal to track your activities | ⃝ |

| Commit to continuous learning and improvement | ⃝ |

Frequently Asked Questions (FAQs)

Is ₹10,000 enough to start trading in India?

Yes, ₹10,000 is enough to begin trading. While it’s not a large amount, it allows beginners to get practical experience, learn discipline, and test strategies without significant risk.

Which type of trading is best suited for small capital like ₹10,000?

Swing trading or delivery-based trading is ideal for small capital. Intraday trading is possible but riskier and usually requires fast decision-making and experience.

Can I buy stocks worth more than ₹10,000 using leverage or margin?

Technically, yes—many brokers offer leverage. But it’s not advisable for beginners. Using leverage can magnify losses as well as gains. Stick to your capital when starting out.

What kind of returns can I expect with ₹10,000?

Returns vary based on market conditions, your strategy, and experience. Expect modest returns initially—think in terms of learning rather than profits. Even 5%-10% growth per month is good for beginners.

Which stocks should I buy with ₹10,000?

Start with fundamentally strong, low-priced stocks (under ₹500) from sectors you understand. Avoid penny stocks and volatile small-caps unless you’ve researched them thoroughly.

What if I lose my ₹10,000 investment?

Losses are part of trading. Use risk management tools like stop-losses and avoid putting the entire amount into a single trade. Think of this as your tuition fee for market education.

How many stocks should I buy with ₹10,000?

Diversify your investment across 2–4 different stocks. This spreads out the risk and teaches you how different sectors behave.

Do I need to learn technical analysis to trade with ₹10,000?

Basic technical analysis (like support/resistance, RSI, moving averages) is highly recommended. It helps you make informed entry and exit decisions, even with a small capital.

Is intraday trading advisable for beginners with small capital?

Not really. Intraday trading requires quick decision-making and tight stop-losses. It’s better to start with swing or delivery trades where you have time to analyze and reflect.

Are there any mobile apps or tools I should use to start trading?

Yes. Apps like Zerodha Kite, Groww, TradingView, and Moneycontrol help track stocks, analyze charts, and stay updated with financial news.

How much brokerage or fees will I pay on trades?

Most discount brokers charge around ₹20 per order for intraday or F&O and offer free delivery trades. Always review the brokerage calculator on your broker’s site to estimate costs.

What if I don’t see profits in the first few months?

That’s normal. The goal in your early days should be to preserve capital and gain experience. Losses are part of the learning curve. With consistency and practice, profitability will follow.

Found this guide helpful? Feel free to bookmark it, share it with fellow traders, and follow along for more straightforward, experience-based insights. I’m here to share what I’ve learned along the way — no hype, just honest trading lessons.